Nick Lazanakis

The business world has become increasingly challenging due to changes in regulation and taxation, as well as political uncertainty. As a result, your business needs an adviser who acts as a change agent, helping to elevate shareholder value, pursue liquidity objectives, accelerate growth strategies and raise capital.

BDO Corporate Finance is a specialist valuation, merger & acquisition and transaction advisory practice, with professionals who understand the full complexity of our clients' needs, capital structures and strategies. With extensive experience across industries, we offer companies a full range of valuation, transaction support, financial modelling, M&A and BEE advisory services through our quality-driven, personal and proactive approach.

Our partner-led teams have entrepreneurial spirit. They will invest the time to understand you, your business and your objectives. Your lead partner will be involved throughout the project, not just in the initial bidding for your business. The team you work with will have the right experience and expertise to help you achieve your strategic objectives, make the most of opportunities and minimise risk.

Regional and global reach and resources

We work with clients across all BDO’s offices in South Africa, drawing on regional knowledge as well as industry and market expertise. As a key member of the BDO international network, we also have a presence in every major global financial and commercial centre across 166 countries, including over 50 locations in Africa.

By working with an international organisation with significant expertise in multiple areas, you benefit from our flexible and pragmatic approach in corporate finance and many other disciplines. Whether that is reviewing your corporate or personal tax position post-transaction, managing your business growth with outsourcing or improving your cybersecurity, we can support your particular business needs.

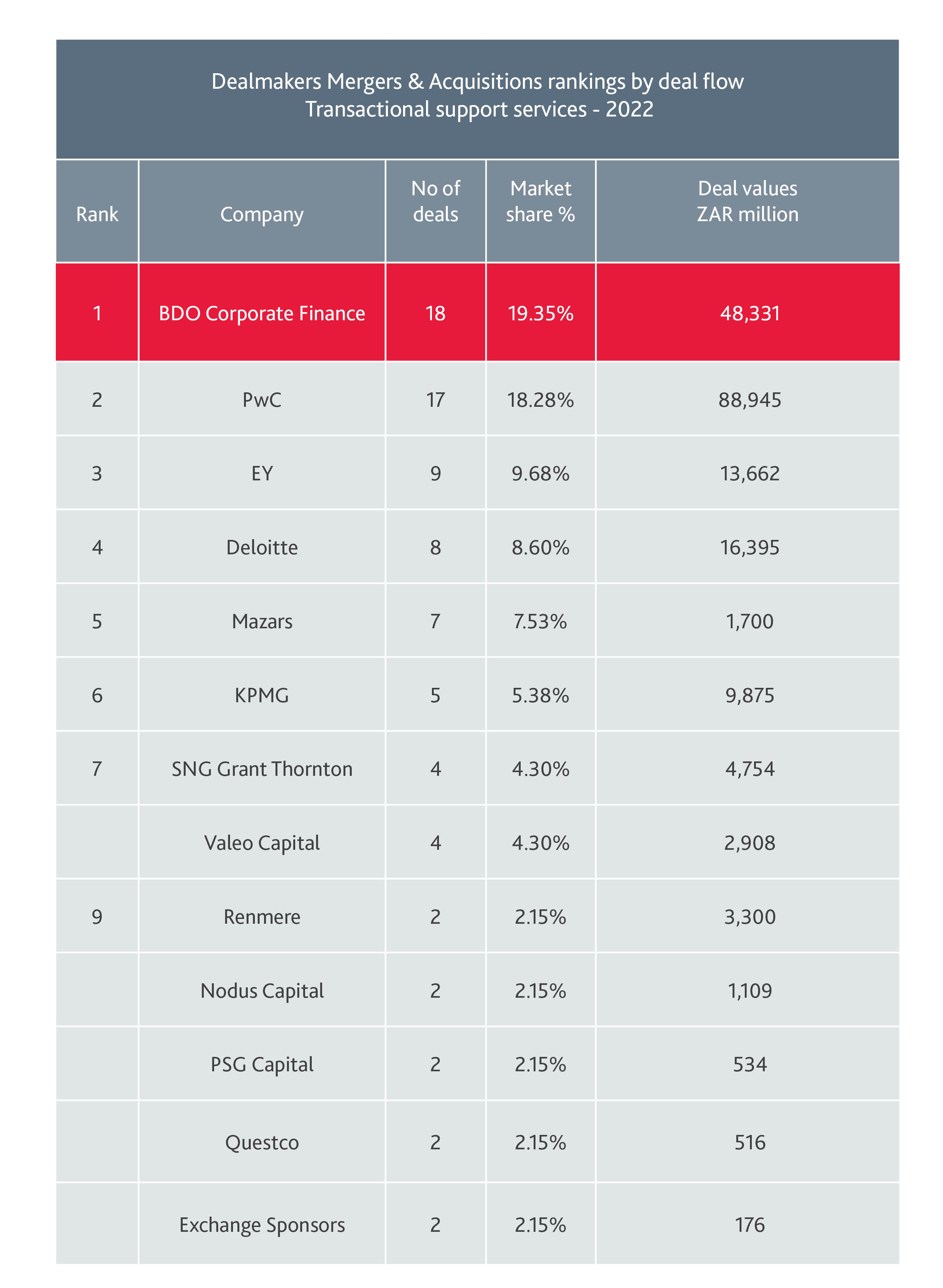

Industry recognition

BDO ranks as a top-tier corporate finance adviser in the Dealmakers Mergers & Acquisitions rankings by deal flow, placing second in 2023 and first in 2020 through 2022.